From Numbers to the Courtroom: How Forensic Accountants Empower Top Litigators

Trusted by Orange County’s Leading Attorneys – Smith Dickson Delivers Financial Clarity When It Matters Most

In today’s complex legal landscape, trial attorneys know that success often hinges on more than just legal expertise—it requires airtight financial evidence. That’s where a seasoned forensic accountant becomes indispensable.

At Smith Dickson, Certified Public Accountants, LLP, we go beyond the spreadsheets. Our team serves as both financial investigators and expert witnesses, transforming complicated data into clear, compelling courtroom narratives.

Strengthening Legal Cases with Financial Expertise

Litigators are under constant pressure to present irrefutable evidence. Our forensic accountants provide detailed, court-admissible reports that stand up to scrutiny. We specialize in breaking down intricate financial transactions and making them understandable to judges and juries alike.

Whether it’s reconstructing records or clarifying damage claims, we help attorneys build stronger, more persuasive cases.

Detecting Fraud and Uncovering Irregularities

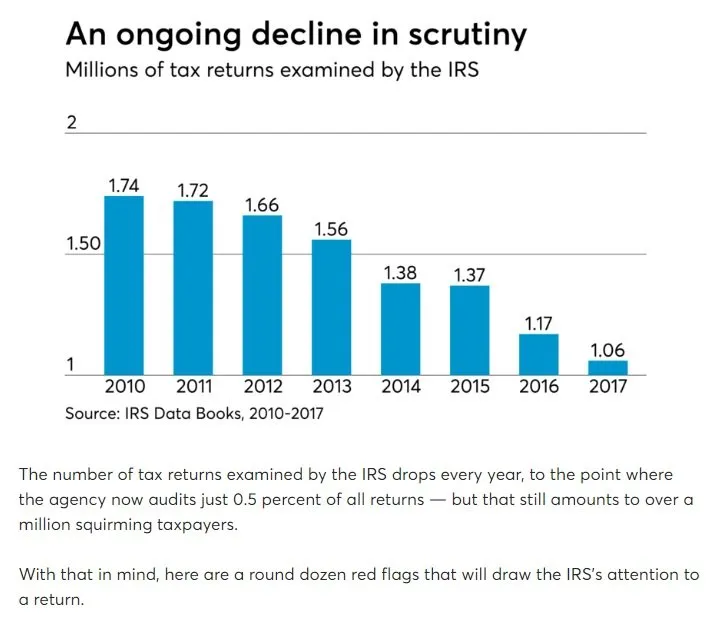

Backed by decades of auditing experience, our team is trained to spot financial red flags. From fraud and misrepresentation to unexplained discrepancies, we meticulously examine records to identify critical details that could shift the direction of a case.

We support litigators across civil and commercial disputes, probate issues, and fraud investigations—always with an eye on delivering the truth behind the numbers.

Experts on the Stand

Our forensic accountants are no strangers to high-stakes environments. We regularly provide expert testimony, explaining complex financial matters in a clear, confident manner—even under intense cross-examination.

We understand the courtroom dynamic and know how to communicate technical insights in ways that resonate with jurors and judges.

Why Litigators Trust Smith Dickson

For attorneys managing complex financial litigation, partnering with the right forensic accountant can make all the difference. At Smith Dickson, we combine deep technical knowledge with courtroom-tested communication skills to help you protect your client’s interests—and win.

Experts in Accounting. Experts on the Stand.

From uncovering the numbers to explaining them in court, Smith Dickson CPA is the forensic accounting expert Orange County litigators trust.