As tax season approaches, the IRS is reminding businesses of the critical deadline for submitting wage statements and information returns by January 31. Timely and accurate filings are essential to avoid penalties and ensure compliance.

What Forms Are Required?:

Form W-2: Employers are required to file Form W-2 (Wage and Tax Statement) and Form W-3 (Transmittal of Wage and Tax Statements) with the Social Security Administration.

Form 1099-NEC: Form 1099-NEC (Nonemployee Compensation) with the IRS.

Additionally, employers and payers must also provide copies of these forms to their recipients by January 31.

Electronic Filing Requirements

Businesses that file 10 or more information returns within a calendar year are required to file electronically. The Information Returns Intake System (IRIS) is an IRS-provided online portal that allows users to prepare forms, make corrections, and request extensions.

To avoid penalties, it is essential to ensure that these forms are filed accurately and by the specified deadline. Late or incorrect filings can result in penalties, so double-checking the information before submission is highly recommended.

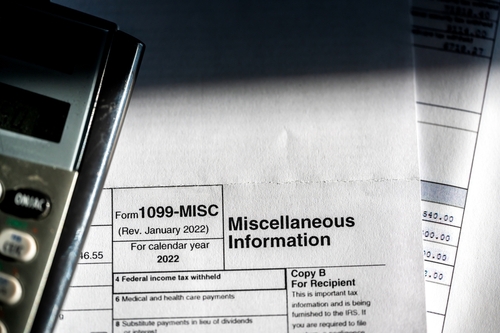

Who Needs a Form 1099?:

Why Accurate Filing Matters:

Incorrect or late filings can result in penalties. To avoid this, work with a Certified Public Accountant (CPA) like Smith Dickson who specializes in tax compliance. With over 30 years of experience as experts in accounting, we can help ensure accurate filings and help businesses navigate complex reporting requirements.

Need Assistance?

Tax season can be overwhelming, but you don’t have to navigate it alone. Contact Smith Dickson CPAs today for expert guidance. Our experienced Certified Public Accountant’s and forensic accountants can assist with everything from accurate filings to identifying potential tax savings.

For more details, you can visit the IRS website and check out their forms, instructions, and other resources. You can also contact Smith Dickson CPAs at 949/533-1020 to discuss your specific needs.